Bridging the Gap in Australia’s Real Estate Market

As the spring season ushers in renewed activity to the Australian property market, we think it’s a great time to explore alternative financing solutions that could be suitable for certain types of buyers and sellers navigating our increasingly complex real estate landscape.

Bridging finance has come a long way and now serves as a strategic tool to tackle the fast-paced property market of today. Its evolution offers not just speed but adaptability, making it a beneficial option for certain buyers.

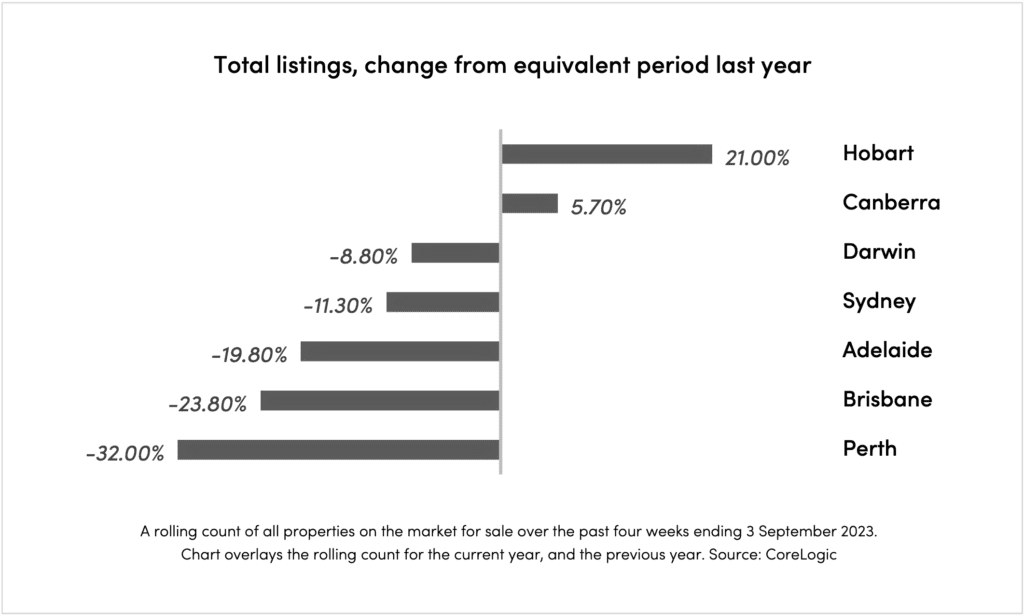

According to CoreLogic’s September Monthly Housing Chart Pack, six out of the eight Australian capital cities are still grappling with a decline in total listings compared to the same period last year. Notably, Perth, Adelaide, Brisbane, and Sydney have all seen a decline of over 10% in total available listings, with Perth experiencing a staggering 32% decrease. This has cultivated a climate of uncertainty, especially for buyers needing to sell their existing property, thereby elevating the necessity for diverse and adaptable financing options.

While CoreLogic’s data does not indicate a recent shortening in the national median days on market, local statistics in specific capital cities tell another story. In Perth, according to the latest REIWA Market Insights, the median selling period for the September quarter stands at just 9 days.

This stark contrast underlines the important role of adaptable financing solutions like bridging finance. The need for buyers to have their financing ready has shifted from a mere advantage to an absolute necessity.

While bridging finance may be an excellent fit for some, it’s not a one-size-fits-all solution. It provides buyers the freedom to act independently of their current property’s sale status and can be tailored for specific needs like upsizing, downsizing, relocating, lifestyle changes and retirement. It provides different structural choices that align to individual financial situations.

At Pendium Finance, we equip real estate professionals with the resources and expertise necessary to better support their clients. If your clients are seeking more information about flexible financial solutions like bridging finance, we’re here to help. We’re also available to present to your team, offering a deeper understanding of how bridging finance may be a beneficial option for clients in today’s market.

Feel free to contact us to see how we can collaborate and aid your clients on their property journey.

Credit Representative 543457 is authorised under Australian Credit Licence 389328.

We recommend that you seek independent financial and taxation advice before acting on any information in this newsletter. It contains general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances. Your full financial situation will need to be reviewed prior to acceptance of any offer or product. Interest rates are subject to change without notice. Lenders terms, conditions, fees & charges apply.

Market Data and Reports

Want to know what is happening in your business area? Get in touch for an update!

"*" indicates required fields